puerto rico tax incentives 2021

Puerto Rico Tax Incentives. Still Puerto Rico hopes to lure American mainlanders with an income tax.

Living In Puerto Rico Archives Jen There Done That

100 exemption from income tax on the appreciation in value of the securities or other assets ie cryptocurrency after becoming a bona fide resident of Puerto Rico and realized before January.

. Puerto Rico offers a 30 tax deduction up to 1500 for expenses incurred in the purchase and installation of solar equipment to heat water for residential use. Ad We file Puerto Rican Hacienda US and Canadian returns. 22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form.

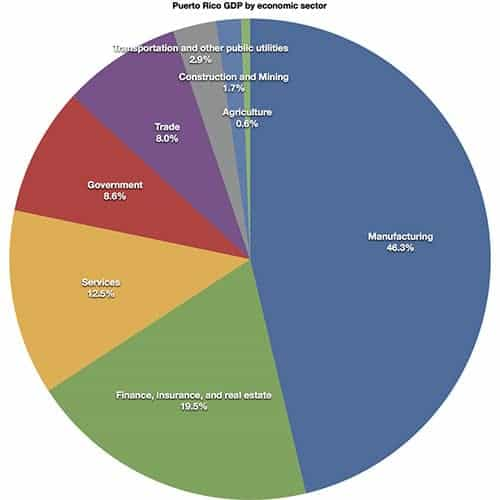

Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. Typically the company engages in providing services to customers outside of Puerto. A decade ago Puerto Rico set out to become a tax haven to lure individuals and companies from both the US mainland and abroad.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. In many if not most cases you must file taxes in two places with the IRS and with the Puerto Rico Department of Finance. Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the.

Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. However a combination of natural disasters government mismanagement and unsustainable debt led to the US commonwealths bankruptcy in 2016. Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico.

Earlier this year the Large Business and International Division of the IRS announced the initiation of a campaign targeting taxpayers who have taken advantage of tax incentives under Puerto Rico Act 22 Act to Promote the Relocation of Individual Investors to Puerto Rico now. Purpose of Puerto Rico Incentives Code Act 60. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has.

Also during the year 2012 two additional laws were enacted. The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

Further the Tax Cuts and Jobs Act passed by the US Congress in 2017 lowered the. The credit will range from 5 to 125 of the gross earned income subject to limitations depending on the amount of dependants claimed by the taxpayer. Authored by Manny Muriel.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. Citizens that become residents of Puerto Rico. As provided by Act 60.

The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. IRS campaign targeting US taxpayers in Puerto Rico is well underway. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the EIC. 27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. 42 Puerto Rico tax and incentives guide 2021.

In January of 2012 Puerto Rico passed legislation making it a tax haven for US. As of January 20 2021 the Puerto Rican government has introduced increased fees for tax incentive applications codified in the Incentive Code Regulation. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US. The Incentives in a Nutshell. Solar equipment is defined as any equipment capable of using solar energy directly or indirectly to heat water whether such equipment is bought or manufactured by the taxpayer provided that the same is operating.

Posted on June 16 2021 by admin. The Code shall create a simple streamlined. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has.

Puerto Rico Workers Yes Colonizers No Workers World

Resources The Northeast Ada Center

Year End Tax Considerations For Puerto Rico Bona Fide Residents Rsm Puerto Rico

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Puerto Rico Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Why 8 Out Of 10 People Are Wrong About Investing In Puerto Rico

Puerto Rico Workers Yes Colonizers No Workers World

Puerto Rico Incentives Code Act 60 2019 Signed Into Law Relocate To Puerto Rico With Act 60 20 22

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Act 20 And 22 Actionable Guide And Alternatives

Wealthy Investors Moving To Puerto Rico For Tax Benefits Cbs News

Puerto Rico Act 20 And 22 Actionable Guide And Alternatives

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Incentives Puerto Rico Tourism Company

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

Press Releases Puerto Rico Chamber Of Commerce

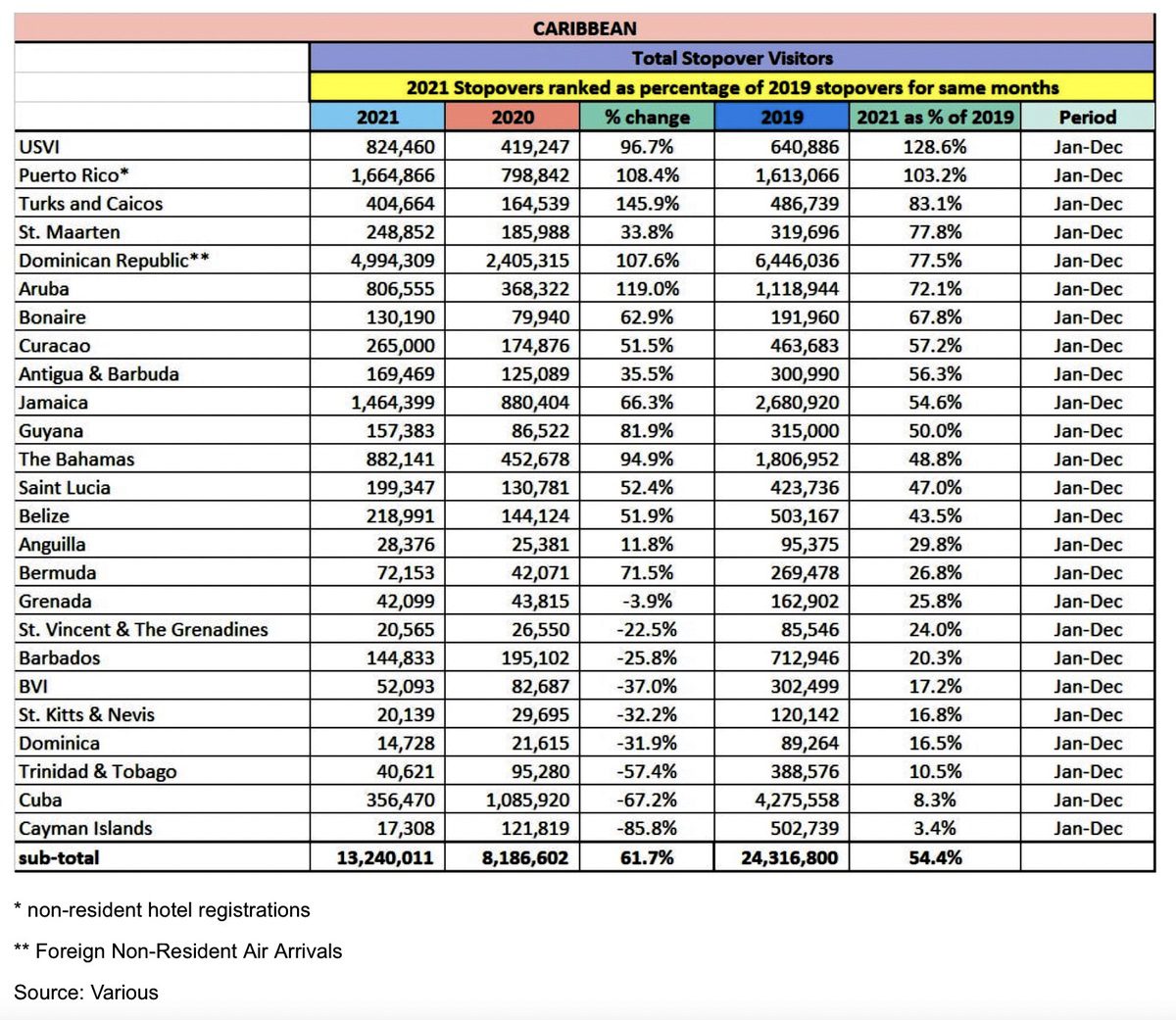

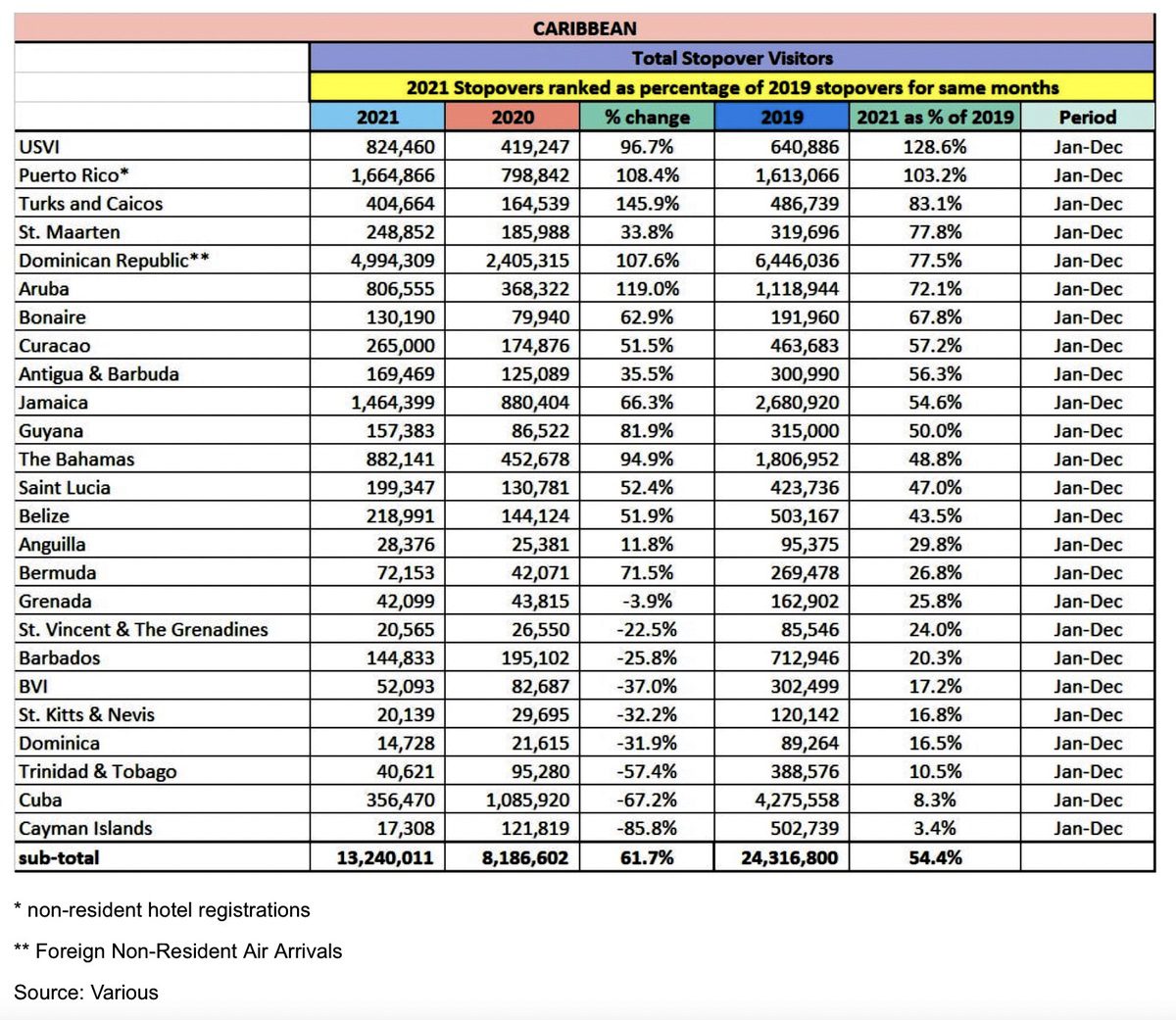

Puerto Rico S Recovery Offers These Lessons For Global Tourism

Is Puerto Rico The Ideal Home For The Crypto Hodler Coin Bureau

Puerto Rico S Generous Tax Breaks And Stunning Beaches Are Attracting An Influx Of Crypto Entrepreneurs Report